How Does Transaction Borrowed Money From A Bank Effect Liabilities

Current Liabilities

75 Prepare Periodical Entries to Record Short-Term Notes Payable

If you have always taken out a payday loan, you may have experienced a state of affairs where your living expenses temporarily exceeded your assets. You need enough money to encompass your expenses until you get your next paycheck. Once y'all receive that paycheck, y'all tin repay the lender the corporeality you borrowed, plus a little extra for the lender's assistance.

There is an ebb and period to business organization that tin sometimes produce this same situation, where business expenses temporarily exceed revenues. Fifty-fifty if a company finds itself in this state of affairs, bills still need to be paid. The visitor may consider a short-term note payable to cover the departure.

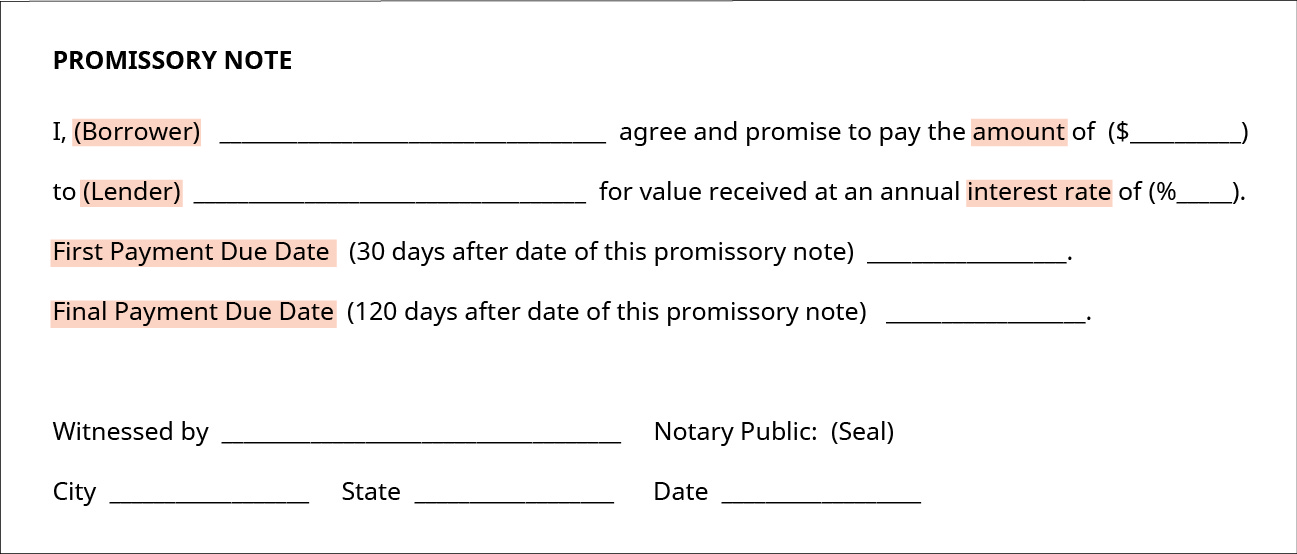

A short-term note payable is a debt created and due within a company's operating flow (less than a year). Some key characteristics of this written promise to pay (run into (Figure)) include an established engagement for repayment, a specific payable amount, involvement terms, and the possibility of debt resale to another party. A short-term annotation is classified as a current liability because it is wholly honored within a company's operating period. This payable account would appear on the balance canvass nether Current Liabilities.

Brusk-Term Promissory Note. A promissory note includes terms of repayment, such every bit the engagement and involvement rate. (attribution: Copyright Rice University, OpenStax, nether CC By-NC-SA 4.0 license)

Debt sale to a 3rd party is a possibility with any loan, which includes a short-term notation payable. The terms of the agreement will land this resale possibility, and the new debt owner honors the agreement terms of the original parties. A lender may choose this selection to collect greenbacks quickly and reduce the overall outstanding debt.

We now consider 2 short-term notes payable situations; one is created past a purchase, and the other is created by a loan.

Promissory Notes: Time to Issue More Debt?

A common practice for regime entities, especially schools, is to upshot curt-term (promissory) notes to embrace daily expenditures until revenues are received from taxation collection, lottery funds, and other sources. Schoolhouse boards corroborate the note issuances, with repayments of chief and involvement typically met inside a few months.

The goal is to fully comprehend all expenses until revenues are distributed from the state. Nevertheless, revenues distributed fluctuate due to changes in collection expectations, and schools may not exist able to cover their expenditures in the electric current period. This leads to a dilemma—whether or not to issue more brusque-term notes to comprehend the deficit.

Short-term debt may be preferred over long-term debt when the entity does non want to devote resources to pay interest over an extended period of time. In many cases, the involvement rate is lower than long-term debt, because the loan is considered less risky with the shorter payback period. This shorter payback period is also benign with amortization expenses; curt-term debt typically does not amortize, unlike long-term debt.

What would you do if you establish your school in this situation? Would you lot issue more than debt? Are at that place alternatives? What are some positives and negatives to the promissory note exercise?

Recording Short-Term Notes Payable Created past a Purchase

A short-term notes payable created by a purchase typically occurs when a payment to a supplier does non occur within the established fourth dimension frame. The supplier might require a new understanding that converts the overdue accounts payable into a brusque-term note payable (come across (Figure)), with interest added. This gives the company more fourth dimension to make practiced on outstanding debt and gives the supplier an incentive for delaying payment. Also, the creation of the note payable creates a stronger legal position for the owner of the notation, since the notation is a negotiable legal instrument that can be more than hands enforced in court deportment.

Accounts Payable Conversion. Accounts Payable may be converted into a short-term notes payable, if in that location is a default on payment. (attribution: Copyright Rice University, OpenStax, nether CC By-NC-SA 4.0 license)

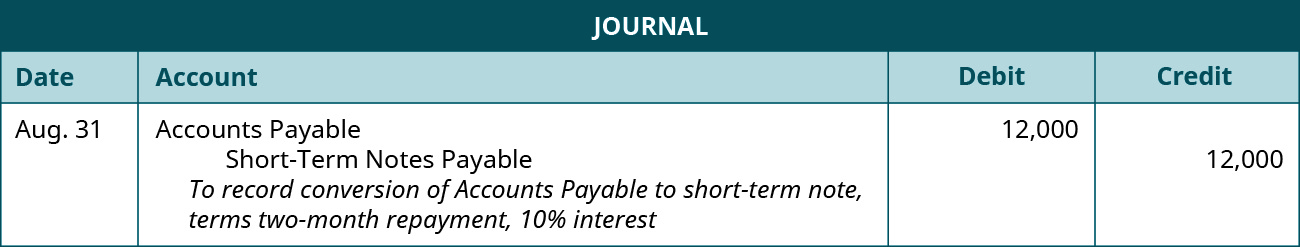

To illustrate, allow's revisit Sierra Sports' purchase of soccer equipment on August 1. Sierra Sports purchased $12,000 of soccer equipment from a supplier on credit. Credit terms were 2/ten, n/30, invoice date August 1. Permit's assume that Sierra Sports was unable to make the payment due within 30 days. On August 31, the supplier renegotiates terms with Sierra and converts the accounts payable into a written annotation, requiring full payment in 2 months, beginning September i. Interest is at present included as part of the payment terms at an annual rate of x%. The conversion entry from an business relationship payable to a Short-Term Note Payable in Sierra'due south journal is shown.

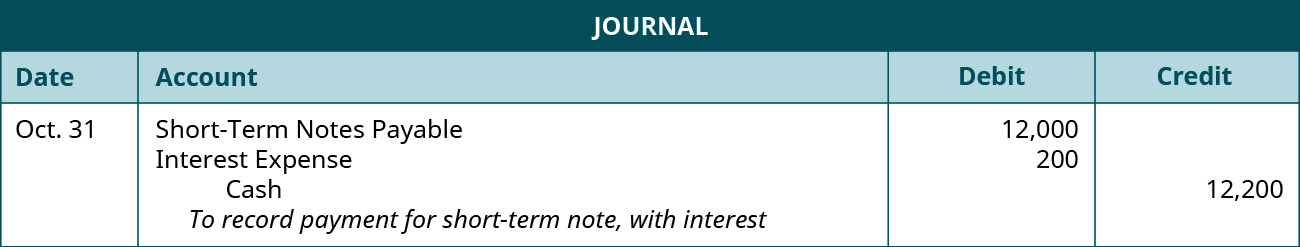

Accounts Payable decreases (debit) and Short-Term Notes Payable increases (credit) for the original amount owed of $12,000. When Sierra pays cash for the full corporeality due, including interest, on Oct 31, the following entry occurs.

Since Sierra paid the full corporeality due, Short-Term Notes Payable decreases (debit) for the main amount of the debt. Involvement Expense increases (debit) for two months of interest accumulation. Interest Expense is found from our before equation, where Involvement = Master × Annual involvement charge per unit × Part of year ($12,000 × 10% × [ii/12]), which is $200. Cash decreases (credit) for $12,200, which is the main plus the interest due.

The other brusk-term note scenario is created by a loan.

Recording Short-Term Notes Payable Created by a Loan

A short-term notes payable created by a loan transpires when a business concern incurs debt with a lender (Effigy). A business may cull this path when it does not have enough cash on mitt to finance a capital expenditure immediately simply does not demand long-term financing. The business may as well require an influx of cash to cover expenses temporarily. There is a written promise to pay the principal residue and involvement due on or before a specific date. This payment flow is inside a company's operating period (less than a year). Consider a short-term notes payable scenario for Sierra Sports.

Banking company Loan. A short-term annotation tin be created from a loan. (credit: "Business Paperwork Bargain" by "rawpixel"/Pixabay, CC0)

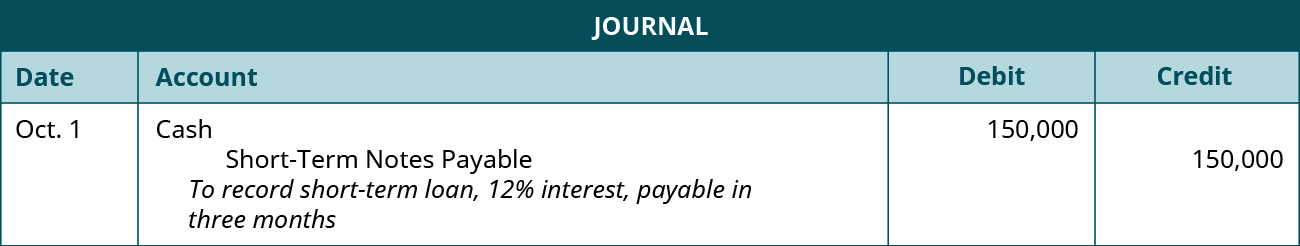

Sierra Sports requires a new dress printing auto subsequently experiencing an increase in custom uniform orders. Sierra does not have enough greenbacks on paw currently to pay for the automobile, but the company does not need long-term financing. Sierra borrows $150,000 from the banking concern on October 1, with payment due within 3 months (December 31), at a 12% annual interest rate. The following entry occurs when Sierra initially takes out the loan.

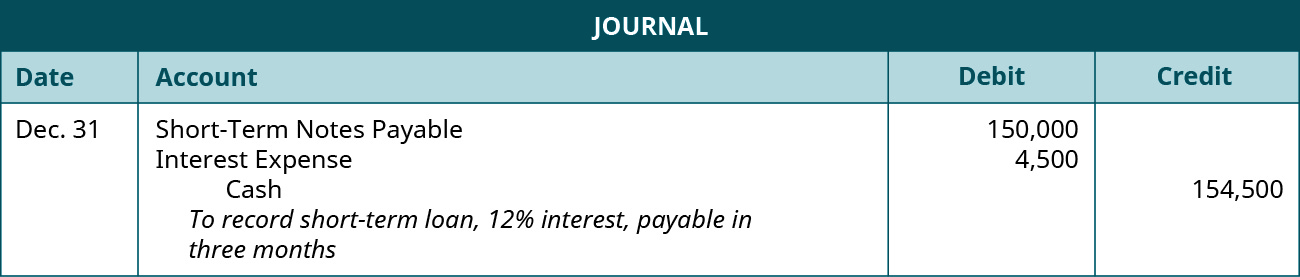

Cash increases (debit) as does Short-Term Notes Payable (credit) for the principal amount of the loan, which is $150,000. When Sierra pays in full on Dec 31, the following entry occurs.

Curt-Term Notes Payable decreases (a debit) for the principal amount of the loan ($150,000). Involvement Expense increases (a debit) for $4,500 (calculated as $150,000 principal × 12% annual interest rate × [iii/12 months]). Greenbacks decreases (a credit) for the main amount plus interest due.

Loan calculators can assist businesses determine the amount they are able to borrow from a lender given certain factors, such equally loan amount, terms, interest rate, and payback categorization (payback periodically or at the stop of the loan, for example). A group of it professionals provides 1 such loan estimator with definitions and boosted information and tools to provide more information.

Key Concepts and Summary

- Brusk-term notes payable is a debt created and due within a company's operating flow (less than a year). This debt includes a written promise to pay principal and interest.

- If a company does not pay for its purchases within a specified time frame, a supplier will convert the accounts payable into a short-term notation payable with interest. When the company pays the amount owed, curt-term notes payable and Cash volition decrease, while interest expense increases.

- A visitor may infringe from a banking concern because it does not have plenty cash on hand to pay for a majuscule expenditure or cover temporary expenses. The loan will consist of short-term repayment with interest, affecting short-term notes payable, cash, and interest expense.

Multiple Choice

(Figure)Which of the following accounts are used when a curt-term note payable with 5% interest is honored (paid)?

- short-term notes payable, greenbacks

- short-term notes payable, cash, involvement expense

- involvement expense, greenbacks

- short-term notes payable, involvement expense, interest payable

(Figure)Which of the following is not a characteristic of a short-term annotation payable?

- Payment is due in less than a twelvemonth.

- It bears interest.

- Information technology tin can upshot from an accounts payable conversion.

- It is reported on the rest sheet under noncurrent liabilities.

(Figure)Sunlight Growers borrows $250,000 from a bank at a 4% annual interest rate. The loan is due in three months. At the stop of the three months, the visitor pays the amount due in full. How much did the visitor remit to the bank?

- $250,000

- $10,000

- $252,500

- $2,500

(Figure)Marathon Peanuts converts a $130,000 account payable into a curt-term note payable, with an almanac interest rate of half-dozen%, and payable in four months. How much involvement will Marathon Peanuts owe at the finish of 4 months?

- $2,600

- $7,800

- $137,800

- $132,600

Questions

(Figure)What is a fundamental difference betwixt a brusk-term note payable and a current portion of a noncurrent annotation payable?

A curt-term notes payable does not take any long-term characteristics and is meant to be paid in full within the company'south operating period (less than a year). The electric current portion of a noncurrent note payable is based off of a long-term debt but is but recognized as a current liability when a portion of the long-term note payable is due. The residuum stays a long-term liability.

(Figure)What concern circumstance could bring about a brusque-term note payable created from a purchase?

(Figure)What business circumstance could produce a short-term notes payable created from a loan?

A business borrows coin from a bank, and the bank makes the note payable within a year, with interest. For example, this could come up from a capital expenditure need or when expenses exceed revenues.

(Figure)Jain Enterprises honors a short-term notation payable. Principal on the note is $425,000, with an annual interest rate of three.five%, due in 6 months. What journal entry is created when Jain honors the notation?

Practice Gear up A

(Figure)Barkers Broiled Goods purchases dog treats from a supplier on February 2 at a quantity of half dozen,000 treats at $1 per treat. Terms of the buy are 2/10, n/30. Barkers pays half the amount due in cash on Feb 28 but cannot pay the remaining balance due in iv days. The supplier renegotiates the terms on March 4 and allows Barkers to catechumen its purchase payment into a short-term annotation, with an annual interest charge per unit of half dozen%, payable in ix months.

Show the entries for the initial purchase, the partial payment, and the conversion.

(Figure)Use information from (Effigy). Compute the interest expense due when Barkers honors the note. Show the journal entry to recognize payment of the short-term note on December 4.

(Figure)Scrimiger Paints wants to upgrade its machinery and on September twenty takes out a loan from the bank in the amount of $500,000. The terms of the loan are 2.9% almanac interest rate and payable in eight months. Involvement is due in equal payments each month.

Compute the interest expense due each month. Show the periodical entry to recognize the involvement payment on October 20, and the entry for payment of the short-term note and final interest payment on May 20. Round to the nearest cent if required.

Exercise Fix B

(Figure)Airplanes Unlimited purchases airplane parts from a supplier on March 19 at a quantity of iv,800 parts at $12.l per role. Terms of the purchase are three/x, n/30. Airplanes pays one-3rd of the amount due in cash on March 30 merely cannot pay the remaining residuum due. The supplier renegotiates the terms on April 18 and allows Airplanes to convert its purchase payment into a short-term notation, with an annual involvement rate of nine%, payable in half dozen months.

Show the entries for the initial purchase, the partial payment, and the conversion.

(Effigy)Utilise information from (Figure). Compute the interest expense due when Airplanes Unlimited honors the note. Show the journal entry to recognize payment of the short-term note on Oct xviii.

(Figure)Whole Leaves wants to upgrade their equipment, and on January 24 the company takes out a loan from the banking concern in the amount of $310,000. The terms of the loan are half dozen.v% almanac interest charge per unit, payable in three months. Interest is due in equal payments each calendar month.

Compute the interest expense due each month. Prove the periodical entry to recognize the involvement payment on Feb 24, and the entry for payment of the brusk-term note and terminal interest payment on April 24. Round to the nearest cent if required.

Problem Set A

(Effigy)Serene Visitor purchases fountains for its inventory from Kirkland Inc. The following transactions take place during the electric current year.

- On July 3, the visitor purchases thirty fountains for $ane,200 per fountain, on credit. Terms of the buy are ii/10, due north/30, invoice dated July 3.

- On August iii, Serene does not pay the amount due and renegotiates with Kirkland. Kirkland agrees to convert the debt owed into a short-term note, with an 8% almanac involvement rate, payable in two months from Baronial 3.

- On October 3, Serene Company pays its account in total.

Record the journal entries to recognize the initial purchase, the conversion, and the payment.

(Figure)Mohammed LLC is a growing consulting firm. The post-obit transactions take identify during the current year.

- On June 10, Mohammed borrows $270,000 from a bank to cover the initial price of expansion. Terms of the loan are payment due in four months from June 10, and annual interest charge per unit of v%.

- On July 9, Mohammed borrows an additional $100,000 with payment due in four months from July 9, and an annual interest rate of 12%.

- Mohammed pays their accounts in full on Oct 10 for the June 10 loan, and on November ix for the July 9 loan.

Record the journal entries to recognize the initial borrowings, and the two payments for Mohammed.

Trouble Set B

(Effigy)Air Compressors Inc. purchases compressor parts for its inventory from a supplier. The following transactions accept identify during the current year:

- On April 5, the company purchases 400 parts for $8.xxx per part, on credit. Terms of the purchase are 4/10, n/30, invoice dated April 5.

- On May five, Air Compressors does not pay the corporeality due and renegotiates with the supplier. The supplier agrees to $400 cash immediately every bit partial payment on annotation payable due, converting the debt owed into a short-term note, with a seven% annual interest rate, payable in three months from May v.

- On August five, Air Compressors pays its business relationship in full.

Tape the periodical entries to recognize the initial purchase, the conversion plus greenbacks, and the payment.

(Figure)Pickles R Us is a pickle subcontract located in the Northeast. The post-obit transactions have place:

- On November six, Pickles borrows $820,000 from a depository financial institution to cover the initial cost of expansion. Terms of the loan are payment due in 6 months from November 6, and annual interest rate of 3%.

- On December 12, Pickles borrows an additional $200,000 with payment due in three months from December 12, and an annual interest charge per unit of 10%.

- Pickles pays its accounts in full on March 12, for the December 12 loan, and on May 6 for the November half-dozen loan.

Record the journal entries to recognize the initial borrowings, and the 2 payments for Pickles.

Idea Provokers

(Effigy)Yous own a farm and grow seasonal products such as pumpkins, squash, and pine trees. Most of your business revenues are earned during the months of Oct to December. The rest of your year supports the growing process, where revenues are minimal and expenses are high. In social club to encompass the expenses from January to September, you consider borrowing a short-term note from a bank for $300,000.

- Research the lending practices of a local bank.

- Decide the interest charge per unit charged for a $300,000 loan.

- What collateral does the depository financial institution require to secure the loan?

- Determine your overall payback amount if you lot were to repay the loan in less than one yr. Choose either a payback with periodic payments or all at the terminate of the loan term, and compare the outcomes.

- After conducting your research, would you consider borrowing the money?

- What positive and negative outcomes accompany borrowing the money?

Glossary

- curt-term annotation payable

- debt created and due within a company's operating menstruation (less than a yr)

Source: https://opentextbc.ca/principlesofaccountingv1openstax/chapter/prepare-journal-entries-to-record-short-term-notes-payable/

Posted by: matticegooked1970.blogspot.com

0 Response to "How Does Transaction Borrowed Money From A Bank Effect Liabilities"

Post a Comment